[ad_1]

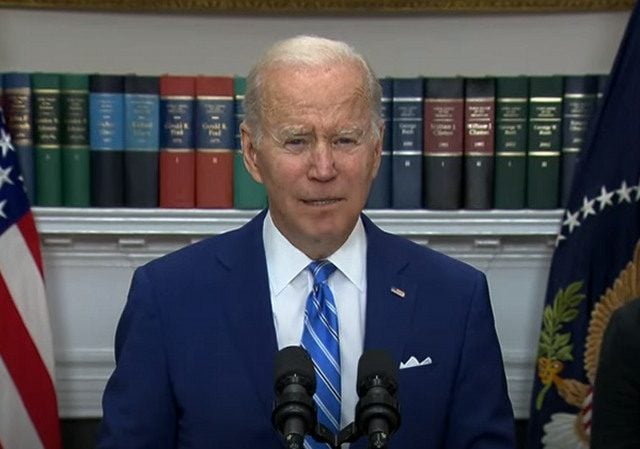

Because of Joe Biden’s financial system and inflation, the variety of Individuals residing paycheck to paycheck has now risen to over 60 %.

It’s a stark reminder of how a lot better issues had been underneath Trump only a few years in the past.

And regardless of this information, Biden exhibits no indicators that he plans to alter any of his insurance policies.

CNBC reviews:

TRENDING: Right here’s How They Did it: Actual-time Election Fraud by Database Latency

Share of Individuals residing paycheck to paycheck rises to 63% — right here’s easy methods to get your funds again on monitor

As rising costs proceed to weigh on households, extra households are feeling stretched too skinny.

As of November, 63% of Individuals had been residing paycheck to paycheck, in accordance with a month-to-month LendingClub report — up from 60% the earlier month and close to the 64% historic excessive hit in March.

Even high-income earners are underneath stress, LendingClub discovered. Of these incomes greater than six figures, 47% reported residing paycheck to paycheck, a bounce from the earlier month’s 43%.

“Individuals are cash-strapped and their on a regular basis spending continues to outpace their revenue, which is impacting their skill to avoid wasting and plan,” stated Anuj Nayar, LendingClub’s monetary well being officer.

Though client costs rose lower than anticipated in November, persistent inflation has precipitated actual wages to say no.

Actual common hourly earnings are down 1.9% from a 12 months earlier, in accordance with the newest studying from the U.S. Bureau of Labor Statistics.

This leaves many Individuals in a bind as inflation and better costs drive extra folks to dip into their money reserves or lean on credit score simply when rates of interest rise on the quickest tempo in a long time.

Already, bank card balances are surging, up 15% in the newest quarter, the most important annual bounce in additional than 20 years.

Biden is a catastrophe.

Worth of eggs up 49.1% from a 12 months in the past.

Child meals up 10.9%.

Electrical energy up 13.7%.

Hen up 12%.

Potatoes up 16.2%.

Milk up 14.7%.

Gasoline up 10.1%.Actual Common Hourly Earnings?

DOWN 1.9%.Households are those paying the worth for the Left’s spending-fueled inflation disaster.

— Steve Scalise (@SteveScalise) December 13, 2022

Issues are in all probability going to worsen earlier than they get higher.

Cross posted from American Lookout.

[ad_2]

Source link