[ad_1]

bluebay2014

The speedy improve in rates of interest around the globe weighed on funding banking exercise this yr as central banks in lots of superior economies took the punch bowl away. The upper price of borrowing in 2022 put the kibosh on 2021’s increase occasions.

Fairness capital markets issuance of $582B (as of Dec. 19) did not even surpass the $733B issued in H2 2021, based on Dealogic information. Debt capital market provide of $6.3T year-to-date slid 30% from a yr in the past. World mergers & acquisition deal values of $3.6T dropped nearly 39% from 2021.

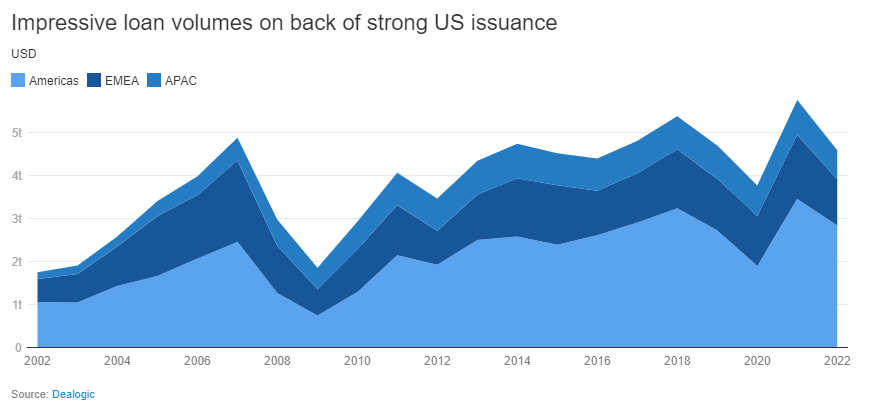

Leveraged finance issuance totaled $444B YTD vs. the document excessive $1.58T raised in 2021. Mortgage capital markets, although, held up for the yr, elevating $4.6T YTD, according to the common over the previous 10 years.

In the course of the yr, JPMorgan Chase (NYSE:JPM) pulled in essentially the most funding banking income for the yr at $5.86B, retaining its prime place. It additionally stayed atop the league tables for debt capital markets, fairness capital markets, and syndicated mortgage income. Wall Avenue rival Goldman Sachs (NYSE:GS) took the prime place in international M&A income, with just below $4B.

In the course of the yr, JPMorgan Chase (NYSE:JPM) pulled in essentially the most funding banking income for the yr at $5.86B, retaining its prime place. It additionally stayed atop the league tables for debt capital markets, fairness capital markets, and syndicated mortgage income. Wall Avenue rival Goldman Sachs (NYSE:GS) took the prime place in international M&A income, with just below $4B.

Prior to now yr, the highest 5 banks within the funding banking league desk noticed their shares drop: JPMorgan (JPM), -17%, Goldman Sachs (GS) -9.9%, Morgan Stanley (NYSE:MS) -13%, Financial institution of America (NYSE:BAC) -27%, and Citigroup (NYSE:C) -26%. However Goldman and Morgan Stanley managed to fall lower than the S&P 500’s 18% decline.

As for the outlook for 2023, listed here are some Dealogic observations:

For M&A, bankers report ample non-public fairness dry powder and money on company steadiness sheets may make for a rebound in offers in 2023. As well as, the persistent valuation hole that had been stifling exercise in 2022 has been closing, Dealogic mentioned. Because of the weakened valuations, “many firms are opting to promote a stake as a substitute of the entire thing,” the corporate’s Insights workforce mentioned.

The damaging headlines within the cryptocurrency sector might set off M&A exercise as firms face depressed valuations and a tough capital-raising atmosphere, wrote Mergermarket’s Rachel Stone. “Firms should transact proper now,” Adam Sullivan, managing director at XMS Capital Companions instructed Mergermarket. “Firms are operating out of money.”

There’s some hope for a rebound in fairness issuances subsequent yr. “There are hopes {that a} interval of investor engagement in ECM following on from a better-than-expected inflation print within the U.S. will proceed into 2023 and {that a} international charge rising cycle will peak mid-way subsequent yr,” Dealogic mentioned.

James Manson-Bhar, head of EMEA ECM syndicate at Morgan Stanley instructed

In leveraged finance, a flurry of offers in December might begin off the yr on optimistic word. Nonetheless, “uncertainties surrounding inflation, rates of interest and the economic system are nonetheless anticipated to pose challenges for leveraged finance markets subsequent yr,” Dealogic’s Jelena Cvejic wrote.

With a recession anticipated subsequent yr, international mortgage volumes will, largely, depend upon how nicely central banks “navigate these unsure waters and their means to information their economies to as delicate a touchdown as doable,” Dealogic’s Ben Watson wrote.

With most of the components that harm markets in 2022 (Russia-Ukraine warfare, Chinese language property disaster, Covid) nonetheless a consider 2023, markets are prone to keep unstable and defaults are anticipated to rise. Moody’s expects international default charges to rise to 4.9% from 2.6%. S&P, in the meantime, estimates U.S. default charges will climb to. 3.75% from 1.6% in 2022 and European default charges to extend to three.25% from 1.4%.

As for equities, strategists count on little from the S&P in ’23, however SA readers nonetheless love shares

[ad_2]

Source link