[ad_1]

BulentBARIS/iStock through Getty Pictures

The week ending Dec. 16 noticed the Federal Reserve elevating its key fee by 50 foundation factors, however the company nonetheless sees extra fee will increase forward as a way to fight inflation. The S&P World U.S. composite PMI got here in decrease than anticipated in December, whereas import and exports costs continued to slip.

Ten out of the 11 S&P 500 sectors ending within the purple with the Industrial Choose Sector SPDR (XLI) dipping (-0.98%) for the second week in a row. The SPDR S&P 500 Belief ETF (SPY) too fell (-2.55%) for the second week straight. YTD, SPY is -19.20%, whereas XLI is -7.29%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +4% every this week. YTD, two out of those 5 shares are within the inexperienced.

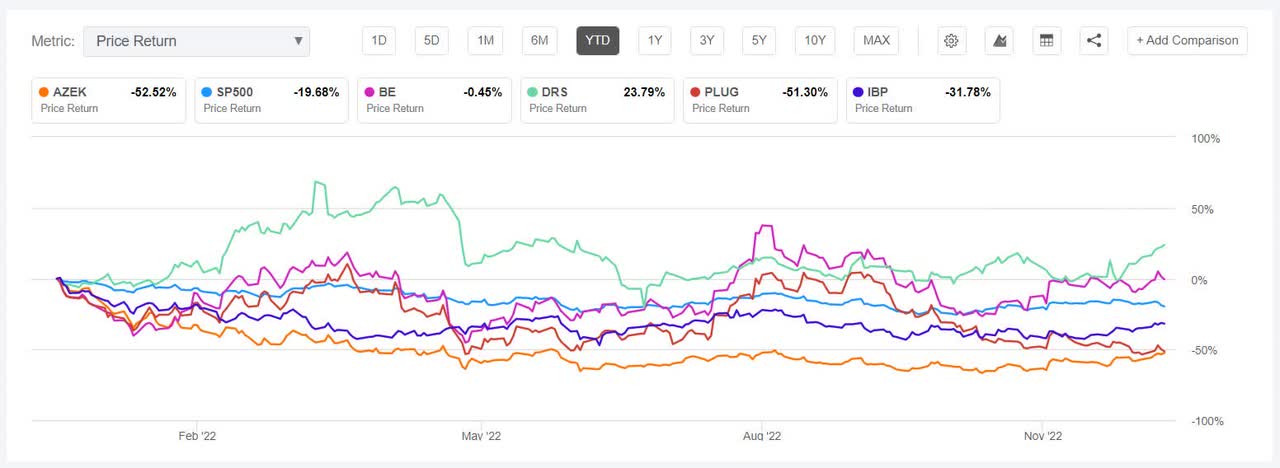

Azek (NYSE:AZEK) +10.57%. The Chicago-based decking and constructing merchandise maker lead the commercial gainers this week however YTD, has declined -53.18%.

The SA Quant Score — which takes under consideration elements equivalent to Momentum, Profitability, and Valuation amongst others — on AZEK is Maintain. The inventory has issue grade of C- for Profitability and D+ for Progress. The typical Wall Avenue Analysts’ Score differs with a Purchase score, whereby 12 out of 20 analysts tag the inventory as Robust Purchase.

Bloom Vitality (BE) +7.67%. The California-based firm — which supplies an influence technology platform — has an SA Quant Score of Maintain, with rating of B+ for Momentum and D- for Valuation. The score is in distinction to the typical Wall Avenue Analysts’ Score of Purchase, whereby 10 out of 30 analysts view the the inventory as Robust Purchase. YTD, the shares have risen +0.50%.

The chart under reveals YTD price-return efficiency of the highest 5 gainers and SP500:

Leonardo DRS (DRS) +7.48%. The protection merchandise maker got here within the gainers checklist for the second week in a row. YTD, the inventory has soared +28.13%, essentially the most amongst this week’s high 5 gainers. The one Wall Avenue Analyst score for DRS is Robust Purchase.

Plug Energy (PLUG) +4.94%. The Latham, New York-based firm leapfrogged from the decliners’ checklist it discovered itself in final week to a spot among the many gainers this week. The inventory gained essentially the most on Wednesday after UBS analyst Manav Gupta began protection of PLUG with a Purchase score citing the corporate’s potential within the “inexperienced hydrogen” trade. The next day, Plug introduced a hydrogen provide and automobile buy settlement with Nikola.

Nonetheless, YTD, the inventory has slumped -50.34%, essentially the most amongst this week’s high 5 gainers. The SA Quant Score on the shares is Promote, with a rating of F for Profitability and D for Momentum. The score is in full distinction to the typical Wall Avenue Analysts’ Score of Purchase, whereby 16 out of 31 analysts see the inventory as Robust Purchase.

Put in Constructing Merchandise (IBP) +4.88%. The Columbus, Ohio-based firm has fallen -33.69% YTD and has an SA Quant Score of Purchase. The typical Wall Avenue Analysts’ Score differs with a Maintain score.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -9% every. YTD, 4 out these 5 shares are within the purple.

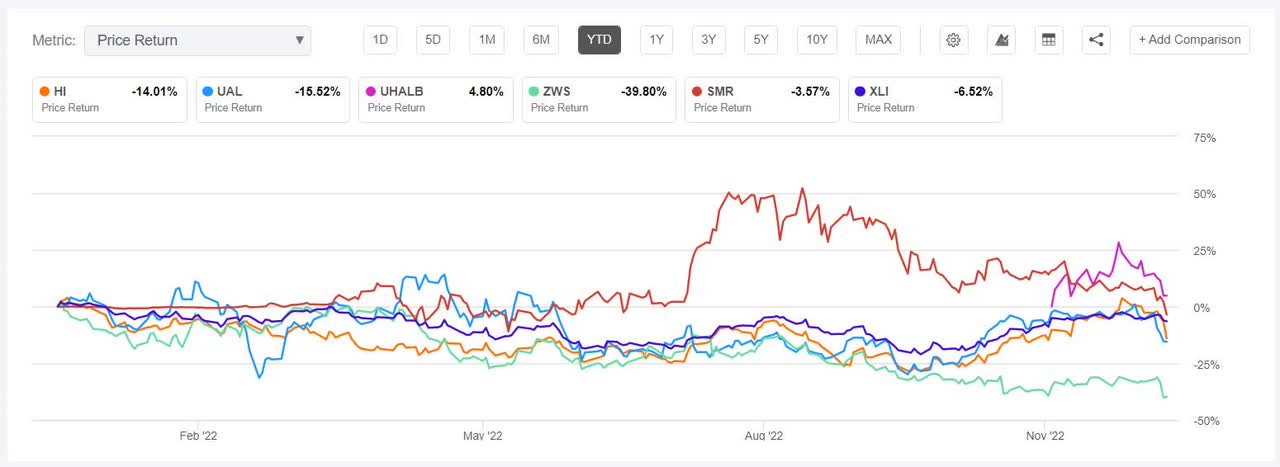

Hillenbrand (NYSE:HI) -11.61%. The Batesville, Ind.-based firm’ inventory fell essentially the most on Friday -8%. A day earlier than this, Hillenbrand stated it was promoting its Batesville enterprise phase to an affiliate of LongRange Capital for $761.5M.

The SA Quant Score on HI is Purchase, with a rating of B- for Profitability and A- for Momentum. The typical Wall Avenue Analysts’ Score is Robust Purchase, whereby 2 out of three analysts seeing the inventory as such. YTD, the shares have dipped -15.33%.

United Airways (UAL) -10.71%. The inventory misplaced steam on Wednesday (-6.94%) after the corporate stated it might purchase as much as 200 planes from Boeing whereas outlining formidable capital expenditure goals.

The SA Quant Score on UAL is Robust Purchase, with a rating of B for Progress and A- for Valuation. The typical Wall Avenue Analysts’ Score on the inventory is Purchase, whereby 7 out of 20 analysts tag the inventory as Robust Purchase. YTD, the shares have declined -12.22%.

The chart under reveals YTD price-return efficiency of the worst 5 decliners and XLI:

Amerco (UHALB) -10.17%. The Reno, Nev.-based trucking and storage service supplier’s non-voting frequent inventory UHALB has risen +1.92% YTD.

Zurn Elkay Water Options (ZWS) -9.98%. The Milwaukee, Wis.-based firm noticed its inventory decline essentially the most on Dec. 15 (-9.95%). YTD, the inventory has shed -40.03%, essentially the most amongst this week’s worst 5 performers. The SA Quant Score on ZWS is Promote, with Profitability carrying a rating of C+ and Progress D-. The typical Wall Avenue Analysts’ Score fully differs with a Robust Purchase score, whereby 5 out of 6 analysts view the inventory as such.

NuScale Energy (SMR) -9.93%. The Portland, Ore-based firm, which develops mild water reactor nuclear energy vegetation, has seen its inventory dip -3.19% YTD. The SA Quant Score on SMR is Maintain, whereas the typical Wall Avenue Analysts’ Score is Purchase.

[ad_2]

Source link