[ad_1]

A sequence of authorized instances within the US is specializing in whether or not Covid-19 could cause invisible injury to insured property — drawing on previous instances involving cat urine and poisonous fuel — as attorneys and advocacy teams try and chip away on the business’s resistance to payouts.

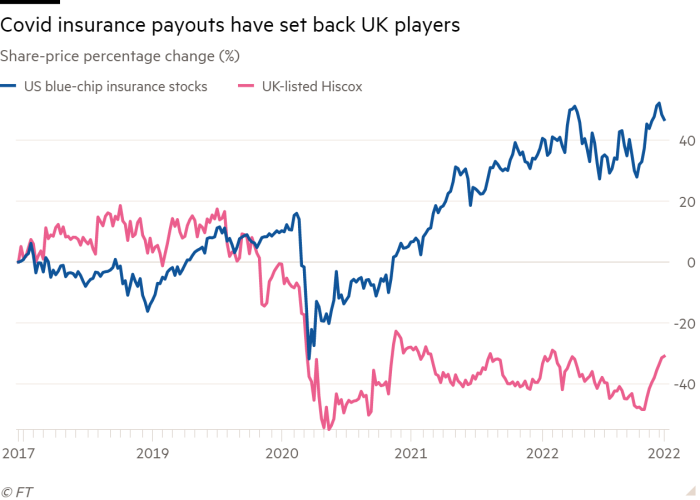

Enterprise interruption insurance coverage throughout the pandemic has been a big price for components of the worldwide insurance coverage business. Disputes over who ought to pay for the price of shuttered factories and empty restaurant tables proceed to rumble by way of courts greater than two years after the disaster started.

However whether or not this sort of insurance coverage has paid out has different by jurisdiction. Policyholders within the UK had a serious win on their enterprise interruption claims in an business take a look at case early final yr, with £1.5bn since paid out by firms together with Lloyd’s of London insurers resembling Hiscox. However within the US, insurers have been extra profitable at seeing off claims, which usually have totally different wording.

In lots of situations, US courts have dismissed instances in response to arguments by insurers that the pandemic didn’t create a “bodily loss or injury” to property as required by insurance policies. A big majority of insurers’ motions to dismiss have been granted, in keeping with a litigation tracker offered by the College of Pennsylvania.

Policyholders have fared higher in some latest instances, nevertheless. In September, Baylor School of Drugs gained a $48.5mn case towards insurers, together with Lloyd’s of London, after a Texas decide determined to place the query of bodily loss to a jury.

“Harm, it may be tangible, it may be intangible, it may be hidden, there are a lot of methods to interpret [that],” stated Robert Corrigan, the healthcare supplier’s normal counsel. “Our view was ask the extraordinary individual.” Virus particles touchdown on surfaces used for affected person consultations broken its property, the corporate argued in court docket.

In the identical month because the Baylor verdict, Vermont’s supreme court docket determined {that a} case introduced by navy shipbuilder HII may progress, and its argument on bodily loss may very well be heard. That reversed an earlier determination in favour of its reinsurers.

In July, an attraction court docket in California overturned a decrease court docket’s determination to dismiss a declare from Marina Pacific Resort & Suites, proprietor of a lodge and restaurant in Venice Seashore, once more figuring out the policyholders have been entitled to at the very least current their case.

“[That decision] in addition to related selections by courts since then vindicate the fitting of policyholders’ to proceed on well-pleaded claims, and ship a powerful message that insurers can not evade their protection obligations with out giving policyholders a good alternative to have their day in court docket and show their claims,” stated David Schack, associate at Barnes & Thornburg, which is representing Marina Pacific.

“It’s actually beginning to warmth up,” stated Robin Cohen, chair of regulation agency Cohen Ziffer Frenchman & McKenna. She is representing restaurateurs Consolidated Restaurant Operations in a case that has reached New York’s highest court docket. “It’s a extremely massive deal that they’re listening to it,” she added. There are millions of policyholders throughout the nation the place New York regulation applies, she stated.

The companies are attempting to overturn insurers’ argument {that a} Covid outbreak is just not a bodily loss that may be claimed beneath property and enterprise interruption insurance policies.

One tack is to argue that premises are bodily modified by Covid-19. Right here, insurance coverage instances are turning to medical science, with attorneys arguing that the virus adheres to surfaces, remodeling them into “fomites”, inanimate objects that may carry illness.

HII argued that this altered and impaired the functioning of its premises, requiring reconfiguration that diminished its capability. Marina Pacific stated it was required to get rid of property that had been contaminated by the virus.

One other argument is that the extent of coronavirus particles impaired the property to a degree the place a declare is justified. Right here, filings check with earlier instances which have disadvantaged policyholders of the usage of property, from an awesome scent of cat urine to the presence of poisonous ammonia fuel.

Insurers, nevertheless, don’t concern any turning of the tide with these instances.

Ken Stoller, assistant vice-president on the American Property Casualty Insurance coverage Affiliation, an business physique, highlighted the rejection of pandemic claims in lots of federal courts, in state excessive courts from Maryland to South Carolina, and different venues.

“The few outlier selections have been on . . . procedural grounds and knowledgeable by very lenient pleading requirements, or have espoused protection theories which have been soundly and repeatedly rejected elsewhere,” he stated. “We don’t count on the present pattern to materially change.”

Even in Vermont, the judges providing a minority opinion towards the policyholders stated fomites “demonstrably don’t have any impact on the tangible, bodily dimension of [the] insured’s property. No cheap individual in [the] insured’s place would assume in any other case.”

Policyholders are being helped in these efforts by marketing campaign teams resembling United Policyholders, a San Francisco-based non-profit organisation. United Policyholders has assisted in lots of of instances throughout greater than 40 states. It has additionally challenged business arguments that permitting claims would push insurers into insolvency.

“A number of appellate courts, together with these in California and Vermont, have not too long ago and appropriately dominated that some of these instances needs to be determined by listening to proof in regards to the science of how Covid-19 causes bodily loss and bodily injury to property,” stated Andrew Hahn of regulation agency Covington & Burling, talking on behalf of United Policyholders. “We hope that the New York court docket [in the Consolidated Restaurant Operations case] will comply with this better-reasoned line of instances and recognise the significance of scientific and different proof in resolving these points.”

Insurers’ success in lots of courts means the business may find yourself with “totally different interpretations of . . bodily loss in several jurisdictions,” stated Cohen. She added: “The insurance coverage business has used their pull in a means that has actually harm the little man.”

[ad_2]

Source link