[ad_1]

New markets require new approaches and ways. Specialists and business leaders take the stage at Inman Join New York in January to assist navigate the market shift — and put together for the subsequent one. Meet the second and be part of us. Register right here.

Know-how makes it simpler than ever for homebuyers to match charges with totally different lenders earlier than taking out a mortgage, however a surprisingly excessive share doesn’t trouble, based on surveys by Fannie Mae and Zillow House Loans.

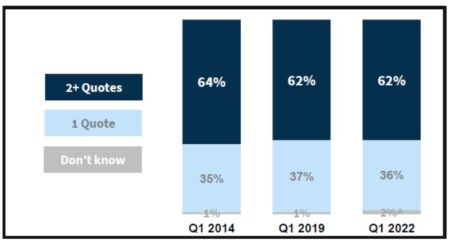

Procuring round can save 1000’s of {dollars}, however about one-third of potential homebuyers solely get a quote from one lender — a quantity that’s hardly modified over time, based on eight years of information from Fannie Mae’s Nationwide Housing Survey.

One in three homebuyers don’t store for a mortgage

Supply: Fannie Mae evaluation of Nationwide Housing Survey information

Zillow House Loans discovered that, on common, customers put extra time into researching automobile purchases and holidays than they do mortgages. Potential homebuyers spend about as a lot time researching a brand new TV as they do mortgage lenders, Zillow’s survey discovered.

As a result of charges and phrases can range by lender, researchers at Freddie Mac have estimated that debtors can save a median of $1,500 over the lifetime of the mortgage by getting one extra fee quote and a median of about $3,000 in the event that they get 5 quotes.

Broadly used know-how, resembling mortgage product and pricing engines make it simple for debtors to get customized charges from a number of lenders, and credit score bureaus gained’t penalize debtors who fee store inside a centered interval of 30-45 days.

So why do homebuyers appear to be so lazy about buying round for one of the best deal?

Fannie Mae discovered that 39 p.c of current homebuyers who solely obtained one quote stated they felt most comfy with the lender to which they utilized. One other 29 p.c stated they have been happy with the primary quote they obtained.

“Homebuyers, particularly first-time homebuyers, might really feel overwhelmed with the complexity of evaluating the various parts that make up mortgage prices, together with rate of interest, closing prices, and factors throughout totally different mortgage presents,” Fannie Mae researchers stated. “Behaviorally, customers may favor to make a fast resolution and decide to go along with their first mortgage quote.”

However that doesn’t clarify why one-third of extra skilled repeat homebuyers additionally solely acquired one quote.

“Their rationalization for less than getting one mortgage quote could also be totally different – maybe some repeat consumers might really feel assured that they obtained one of the best deal from a lender they belief, or maybe they’re much less worth delicate,” Fannie Mae researchers speculated. “Extra behavioral analysis possible must be executed to clarify why repeat homebuyers search mortgage quotes with roughly the identical frequency as first-time homebuyers.”

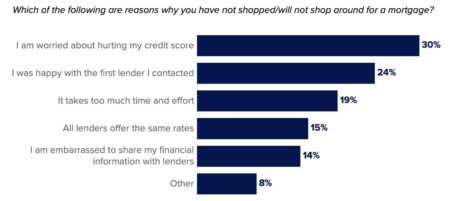

Causes given for not buying

Supply: Zillow House Loans survey

Zillow House Loans’ survey of potential homebuyers discovered that amongst those that had no plans to buy, 30 p.c have been anxious that getting a number of quotes would damage their credit score rating and 15 p.c thought all lenders provide the identical charges.

Neither of these beliefs is true, and the 19 p.c who stated “it takes an excessive amount of effort and time” to match charges is probably not conscious that many lenders and mortgage marketplaces can present personalised fee quotes in minutes. The Client Monetary Safety Bureau additionally presents a mortgage fee exploration instrument powered by Informa Analysis Providers, which collects the information straight from lenders.

Additional innovation “to simplify the method by which customers can evaluate mortgage quotes would assist a considerable portion of homebuyers make higher, extra knowledgeable choices,” Fannie Mae researchers stated.

Zillow House Loans’s survey was performed on-line by The Harris Ballot from Aug. 29-31, reaching 3,082 adults together with 1,104 who have been trying to purchase a house within the subsequent two years. The survey discovered 72 p.c of potential consumers hadn’t shopped for a mortgage and didn’t plan to take action, and that almost half (46 p.c) of potential consumers who submitted purposes for mortgage pre-approval solely submitted one utility.

“House consumers ought to take the time essential to make an informed resolution on their mortgage,” stated Zillow House Loans Vice President Libby Cooper in a press release. “It’s usually the biggest monetary resolution somebody makes.”

Homebuyers who get a number of quotes are “considerably extra possible” to attempt to negotiate prices like their rate of interest, origination charges, insurance coverage and appraisal charges, Fannie Mae’s analysis exhibits.

A better share of Hispanic homebuyers reported negotiating extra prices, together with mortgage fee and low cost factors than white or Black homebuyers, Fannie Mae stated. Larger-income homebuyers have been additionally extra more likely to report negotiating mortgage-related prices than lower-income homebuyers.

However hardly anybody outlets for title and settlement companies after receiving their lender’s closing price estimate, with Fannie Mae discovering 91 p.c of homebuyers glad to associate with no matter their lender or Realtor recommends.

“Title firms, subsequently, might expertise little or no competitors from a value perspective, notably after they turn into an organization that’s ceaselessly beneficial by brokers and lenders,” Fannie Mae researchers concluded.

The CFPB recommends that debtors use their mortgage estimate to determine companies they will store for. Lenders are required to supply an inventory of firms that present such companies.

“Lenders or actual property brokers may suggest suppliers they’ve a relationship with, however these suppliers may not provide one of the best deal,” the CFPB warns. “You possibly can usually get monetary savings by buying round for closing companies.”

For debtors placing lower than 20 p.c down, purchasing for personal mortgage insurance coverage may additionally get monetary savings.

Polly, a know-how supplier for mortgage capital markets, can serve up quotes from the nation’s six largest personal mortgage insurers inside its product and pricing engine, serving to debtors assess their choices and streamlining the mortgage insurance coverage course of for lenders.

Get Inman’s Further Credit score E-newsletter delivered proper to your inbox. A weekly roundup of all the most important information on the planet of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

E mail Matt Carter

[ad_2]

Source link