[ad_1]

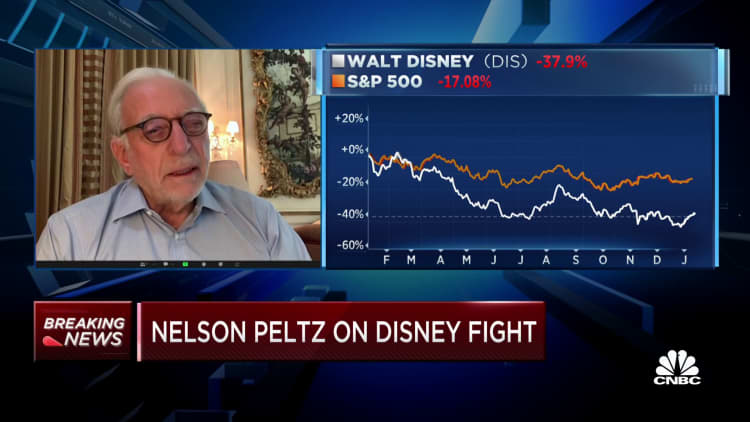

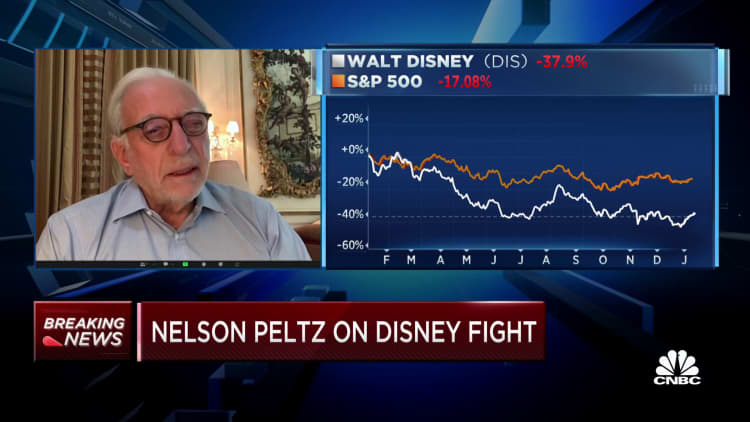

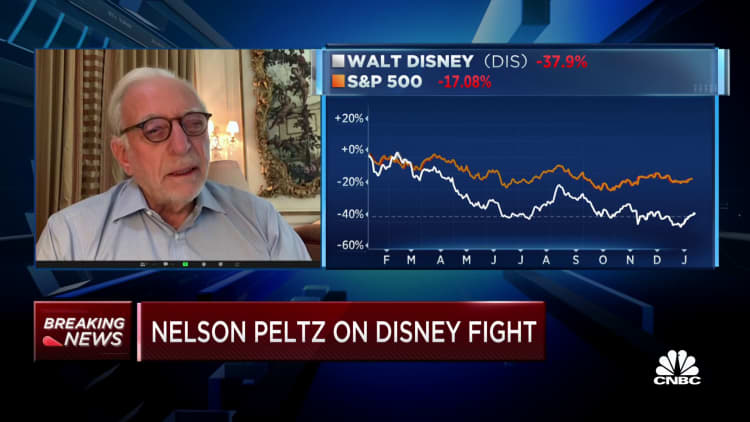

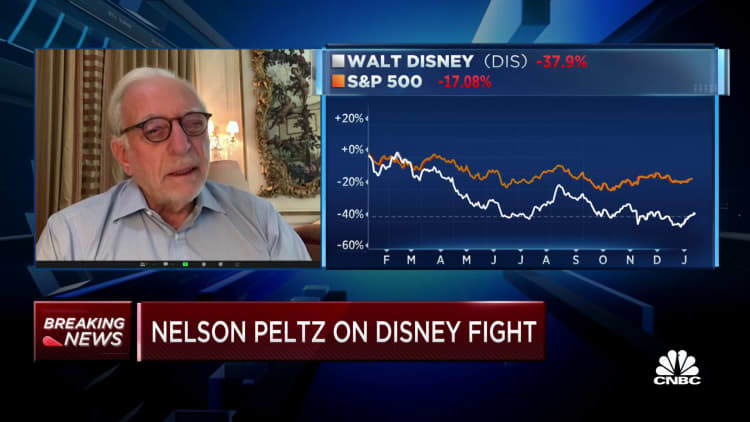

Disney is dealing with a proxy struggle as Nelson Peltz’s activist agency Trian Fund Administration pushes for a seat on its board.

Peltz spoke on CNBC’s “Squawk on the Road” on Thursday, making his case for the struggle his agency has picked with Disney, elevating points with Disney’s $71 billion acquisition of Fox in 2019 and the way the corporate has eroded shareholder worth in recent times.

“Fox damage this firm. Fox took the dividend away. Fox turned what was as soon as a pristine steadiness sheet into a multitude,” Peltz stated Thursday.

On Thursday, the activist agency filed a preliminary proxy assertion seeking to put Peltz on Disney’s board.

To preempt what may very well be a messy proxy battle and opposing Trian, Disney on Wednesday introduced that Mark Parker, the manager chairman of Nike, would grow to be the brand new chairman of the board. Disney’s board will now have 11 members.

The activist agency stated it owns about 9.4 million shares valued at roughly $900 million, which it first amassed a number of months in the past. Trian stated Wednesday it believes Disney “misplaced its method leading to a fast deterioration in its monetary efficiency.”

Peltz additionally stated he needs to be on the board so he can get entry to inner numbers and inform different members in the event that they’re lacking out on alternatives.

“I need not overwhelm them,” Peltz advised CNBC. “I do not want a couple of particular person on the board.”

Shares of Disney had been up about 3% on Thursday.

Peltz’s grievances

Trian referred to as out what it considered as poor company governance on Disney’s half, together with failed succession planning, “over-the-top” compensation practices and Disney’s lack of engagement with Trian in current months.

In public filings Thursday, Trian listed its quite a few conferences with Disney and its board members, starting with then-CEO Bob Chapek, Peltz and their wives over lunch in July. Conferences and correspondence between Trian and Disney ramped up in frequency in November, in response to the submitting.

Peltz on Thursday stated he solely had a gathering with Disney’s board that spanned about 45 minutes, however he by no means heard a response from them. A Disney consultant did not instantly reply to remark.

Peltz additionally famous that Disney was open to creating him a board observer, permitting him to take a seat in on conferences and provides recommendation on operations, however with out voting privileges.

“I need not overwhelm them. I simply want to talk fairly to those individuals and clarify to them the place they went mistaken or what alternatives they’re lacking,” Peltz stated Thursday, noting corporations different the place he is sat on the board.

Folks near Disney advised CNBC’s David Faber they disputed Peltz’s model, saying as an alternative the corporate supplied him the chance to enter into an information-sharing pact beneath a nondisclosure settlement, together with alternatives to satisfy with administration and the board every quarter. Disney didn’t provide him the flexibility to take a seat in on board conferences, the individuals added.

In November, Bob Iger made a shocking return to Disney’s helm, ousting Chapek – whom Iger selected as his successor – following a poor earnings report. Trian has stated it does not wish to substitute Iger, however slightly work with him to make sure a profitable CEO transition inside the subsequent two years.

Parker will take over as chairman from Susan Arnold, and might be tasked to steer succession planning, in response to Disney’s announcement on Wednesday.

In Thursday’s submitting, Trian additionally referred to as out Disney’s streaming technique, saying it’s “fighting profitability, regardless of reaching comparable revenues as Netflix and having a big IP benefit.” The agency additionally criticized what it believes is Disney’s lack of price self-discipline and overearning at its theme parks enterprise to subsidize streaming losses.

Disney’s inventory had a tough 2022, popping out of the early days of the pandemic, when theme parks and film theaters had been shut down. Nonetheless, as subscriber progress for streaming slowed and buyers raised questions on profitability, whereas cord-cutting ramped up, most media shares fell final yr.

On Thursday, Peltz stated Disney both must get out of the streaming enterprise, or purchase Hulu. “They have to purchase Hulu, that sadly means the corporate can have a debt load going ahead for a number of years,” Peltz stated.

Whereas Disney+ is the corporate’s major play in streaming, Disney additionally owns two-thirds of Hulu and has an choice to purchase the remaining stake from Comcast as early as January 2024.

Final yr, Disney additionally introduced it might proceed with cost-cutting measures, together with a hiring freeze that Iger has upheld.

–CNBC’s David Faber contributed to this report.

Watch on CNBC’s full interview with Nelson Peltz on PRO:

Disclosure: Comcast is the father or mother firm of NBCUniversal, which owns CNBC.

[ad_2]

Source link