[ad_1]

The large run-up in dwelling costs could have cooled, however the 2023 conforming mortgage restrict goes up 12 p.c to $727,200 in most components of the nation.

New markets require new approaches and techniques. Specialists and trade leaders take the stage at Inman Join New York in January to assist navigate the market shift — and put together for the following one. Meet the second and be part of us. Register right here.

Federal regulators gave mortgage giants Fannie Mae and Freddie Mac the inexperienced gentle to again mortgages of as much as $726,200 in most components of the nation subsequent 12 months, and loans exceeding $1 million might be truthful sport in additional than 100 higher-cost counties and Census areas the place it’s laborious to seek out properties for much less.

The large run-up in dwelling costs could have cooled for now, however the Federal Housing Finance Company introduced a 12 p.c improve in Fannie and Freddie’s 2023 conforming mortgage restrict Tuesday, based mostly on dwelling worth beneficial properties via Sept. 30.

Underneath a components mandated by Congress, the conforming mortgage restrict is tied to annual will increase in FHFA’s seasonally adjusted, expanded-data Home Value Index. That index, additionally launched Tuesday, confirmed dwelling costs posted 12.4 p.c annual beneficial properties through the third quarter.

“Home costs have been flat for the third quarter however continued to stay above ranges from a 12 months in the past,” stated FHFA economist William Doerner in an announcement. “The speed of U.S. home worth progress has considerably decelerated. This deceleration is widespread with about one-third of all states and metropolitan statistical areas registering annual progress under 10 p.c.”

The $79,000 improve within the conforming mortgage restrict will come as a reduction to huge lenders like Rocket Mortgage and United Wholesale Mortgage, which had already began pricing loans of as much as $715,000 as conforming in September.

It’s additionally excellent news for a lot of debtors seeking to take out loans that exceed the 2022 conforming mortgage restrict, which is at present $647,200 in most components of the nation.

As a result of Fannie and Freddie can’t purchase or assure “jumbo” mortgages that exceed that restrict, jumbo mortgages are likely to have stricter underwriting and better down cost necessities, and a few debtors may additionally pay larger charges than they might for conforming loans.

Whereas the brand new limits don’t take impact till Jan. 1, lenders can deal with loans that exceed the present restrict as conforming by holding them on their books for a number of weeks till the rise turns into official.

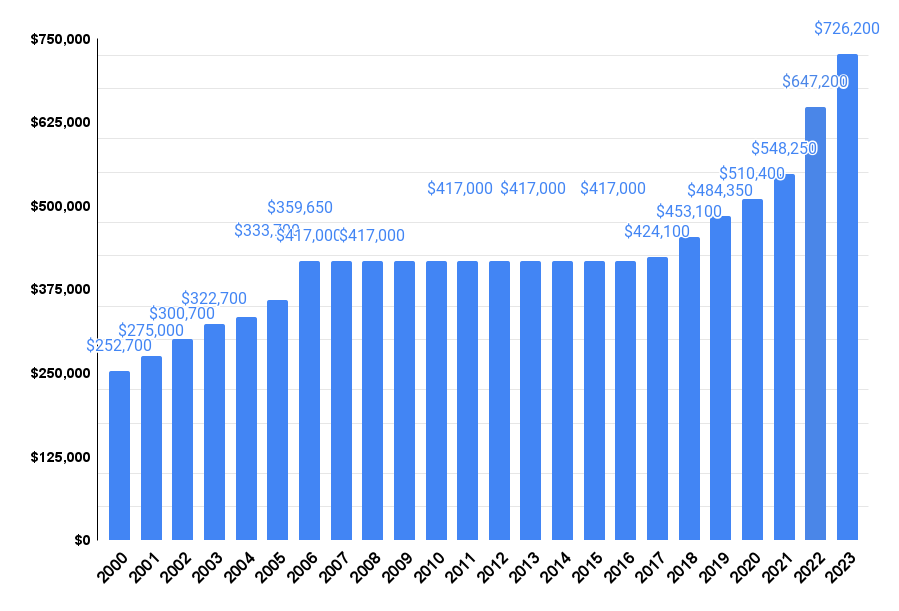

Baseline conforming mortgage restrict, 2000-2023

The speedy run-up in dwelling costs through the pandemic drove an 18 p.c improve within the 2022 conforming mortgage restrict, the largest leap in data courting to 1970. Whereas this 12 months’s improve isn’t as massive, it pushes the conforming mortgage restrict in some higher-cost markets above $1 million for the primary time.

In higher-cost markets, Fannie and Freddie are allowed to buy larger mortgages based mostly on a a number of of the median dwelling worth, as much as a ceiling that’s equal to 150 p.c of the baseline conforming mortgage restrict. For 2022, the brand new ceiling mortgage restrict for one-unit properties in high-cost areas might be $1,089,300.

The conforming mortgage restrict will exceed $1 million in 105 counties and Census areas concentrated in 9 metro areas the place dwelling costs are far above the nationwide common. The conforming restrict may also be larger than the $726,200 baseline however lower than $1 million in 58 counties nationwide.

Final 12 months’s huge improve within the conforming mortgage restrict fueled a debate over housing affordability and competitors within the mortgage trade. Having Fannie and Freddie assist finance purchases of $1 million properties complicates the Biden administration’s objectives to assist extra low-income People change into homebuyers and handle racial homeownership gaps.

To guarantee that the mortgage giants are targeted on serving to first-time homebuyers, low-income debtors and underserved communities, final month federal regulators ordered Fannie and Freddie to slash upfront charges on many buy loans. To offset the influence of these payment reductions, Fannie and Freddie might be required to cost larger charges for many cash-out refis beginning Feb. 1, 2023.

FHFA had beforehand ordered Fannie and Freddie to extend charges on high-balance loans and loans used to buy second properties. These payment will increase took impact on April 1.

Get Inman’s Further Credit score E-newsletter delivered proper to your inbox. A weekly roundup of all the largest information on the earth of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

Electronic mail Matt Carter

[ad_2]

Source link