[ad_1]

The adjustments of the final three years have many people reassessing our monetary wants and what it actually appears wish to be glad, and reside nicely. In line with the co-founder of Stackin, Tom Brammar, many long-held beliefs, patterns from our upbringing, and social fears maintain many people from managing our cash in a approach that might carry us extra pleasure.

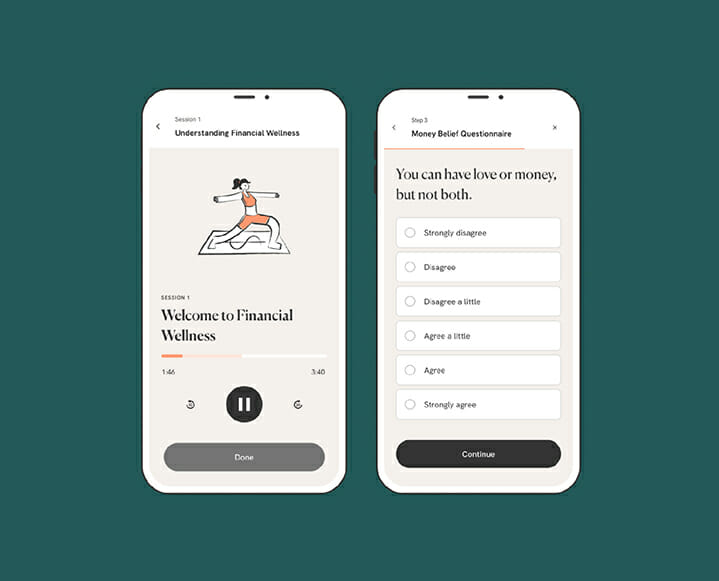

The beliefs-driven language Tom makes use of in our interview beneath is a inform to how his app, Stackin actually works. Sure, you’ll obtain a customized plan from the Stackin staff, set objectives and deal with development, however not earlier than taking time to perceive the place your hang-ups with finance administration actually are.

Re-Consider Your Nervousness About Cash

with Stackin’s Tom Brammar

Brammar unpacks the commonest hang-ups that maintain many people again from monetary wellness. In case you make only a handful of resolutions this 12 months, think about dealing with your fears round cash and taking your monetary well being to a different stage.

With the Stackin app, you’ll learn the way your cash impacts your feelings, so you possibly can prioritize the issues that carry you essentially the most pleasure!

What do you assume holds most individuals again from managing their funds in a approach that works?

We’ve discovered that there are 4 core causes folks draw back from managing their cash nicely:

Lack of monetary schooling. We’re by no means actually taught easy methods to handle our cash. We’re advised to finances, and to ensure we’re saving sufficient, however there may be little or no effort put in to show folks how to do these issues.

Early beliefs about cash. We have now a relationship with cash that’s formed early in our lives, however very hardly ever look at it. That relationship is constructed on a collection of beliefs about cash, which influences our habits. Once we don’t take the time to really examine our personal mindsets about cash, it’s troublesome to alter our habits.

Lack of customized planning. The thought of there being one solution to handle our funds is a fallacy. We’re all totally different, and what works for one individual may not work for another person. We nonetheless discuss being ‘good’ or ‘dangerous’ with cash as if there’s a single method! We have to change what ‘good’ appears like, and the way we discuss cash with one another.

Lack of goal-setting is a frequent block for a lot of of our customers. It’s useful to develop an outlined thought of what you truly need out of your cash. Personalised priorities enable you to to outline a extra significant sense of happiness than the dopamine hit we get from purchasing with no plan.

Many individuals get nervous about juggling numbers – particularly when they’re connected to greenback indicators! How does Stackin assist those that are anxious about managing their cash?

Making an attempt to determine easy methods to handle your cash by gazing these numbers with greenback indicators is like making an attempt to drop some pounds by staring on the dial in your weight scale.

We predict there’s loads of proof to indicate that this fixation doesn’t work and so we’re pioneering a unique method.

First, we have to acknowledge that our habits with cash is ruled nearly solely by our relationship with it. This in flip is the results of our beliefs round what cash is and the way we should always work together with it.

Do you exhibit “cash safety” or “cash romance” habits?

Analysis means that these beliefs are fashioned very early in our lives – between the ages of 6-10 years previous — after which are embedded deep in our limbic system. Our beliefs are so highly effective that they management our habits in methods which are exterior of our on a regular basis consciousness. Regardless of how laborious we attempt to act in a logical method, if that logic goes towards long-held beliefs and our pure limbic response, our limbic response at all times wins.

In case you grew up in a household with a historical past of cash worries, it’s probably that you simply’ll exhibit habits that we title “cash safety”; in case you skilled a adverse change in your loved ones’s monetary circumstances early in your life, you’re extra prone to exhibit “cash romance” habits. At Stackin, we assist to diagnose these behaviors after which create a customized pathway to handle and harness these limbic reactions so we will take again management and begin to use our cash in ways in which make us glad and fulfilled.

So many really feel that as a result of they don’t have “sufficient” cash, they can’t handle their funds in an organized approach. You will need to have so much to say about that! Inform us what these finance-averse of us ought to know.

Some of the highly effective issues we ask a person to do after they’ve first signed up on Stackin is to categorize their most up-to-date discretionary transactions by how these purchases made them really feel and never by its quantity or service provider.

Now they’re confronting whether or not or not all these Amazon purchases truly introduced them actual pleasure.

By way of this we discover that many individuals who really feel like they’re dwelling paycheck to paycheck are literally spending a considerable amount of the cash they’ve management over on issues that don’t make them glad.

Our subsequent step is then to encourage them to alter this habits – not scale back their spending, however modify it to deal with issues that make them happier. We discover that these people understand they really do have management over their cash and might alter their spending patterns to liberate money to place in direction of their longer-term objectives.

3 Myths About Cash Administration To Overcome

01 The answer to cash nervousness is solely to earn extra money.

Not true. Practically a half of all Individuals who earn greater than $100k and practically a 3rd incomes over $250k admit to feeling they’re dwelling paycheck to paycheck.

02 The answer to cash nervousness is solely to “Make a finances!” or “Observe your spending higher!”

Though nicely that means, this recommendation by no means helps repair the issue. The truth is, it might probably truly make the scenario worse when an individual perceives they’ve failed at what looks as if such a easy activity as a result of it creates extra adverse feelings, additional growing despondency and a scarcity of basic confidence.

03 The concept that some individuals are simply “dangerous with cash” as a result of they’re too emotional.

We disagree strongly. Our feelings inspire and encourage us. You aren’t “dangerous at cash”, you simply haven’t been arrange for achievement. Tapping into what motivates us is how we modify our relationship with cash and obtain our objectives.

Are you able to inform us as latest story from a consumer that thrilled the Stackin staff?

The smallest wins are usually those we have fun essentially the most as a result of they typically occur in the beginning of our customers’ journeys.

Considered one of our customers not too long ago broke up together with her boyfriend and as an alternative of panicking and splurging on Doordash (which generally makes her really feel guilt and disgrace), she stopped herself and as an alternative was ready to make use of that $100 for brand new furnishings as she will get her personal place. That may not appear to be an enormous change — she’s nonetheless spending the identical amount of cash — however she’s not utilizing cash to emotionally cope, and is as an alternative prioritizing what makes her really glad.

Stackin helps customers to method their funds as a wellness problem. Discuss to us about that.

Within the early phases of our product analysis, we carried out over 250 hours of consumer interviews with Individuals throughout the nation. What we discovered was these people clearly understood what they needed to do to enhance their monetary well being and easy methods to do it however couldn’t perceive why they weren’t capable of do it.

They’d grand ambitions: shopping for a home, retiring early, taking the sort of trip that Instagram is algorithmically designed to advertise to make the remainder of us really feel jealous. However they persistently did not make these objectives occur. This in flip affected their confidence, their view of their very own self-worth, drove up emotions of hysteria and despair, and in flip fed again into their basic incapacity to take the actions required to enhance their monetary well being.

It was at this level {that a} gentle bulb went off: we have been fascinated with this the incorrect approach round. This wasn’t a finance downside.

This was a well being downside. We love that method. There’s a shocking quantity of peace that comes from seeing how your cash strikes and never hiding out of your finances. How does Stackin get folks began there?

We love that method. There’s a shocking quantity of peace that comes from seeing how your cash strikes and never hiding out of your finances. How does Stackin get folks began there?

Once you be ok with your cash, then seeing the place it’s going can really feel thrilling and empowering. In case you don’t be ok with your cash, budgets can really feel overwhelming and miserable.

What we do is assist folks construct sustainable monetary behaviors in order that they will obtain their objectives. We assist our customers to know their relationship with cash, and we assist them construct the behaviors that give them confidence with regards to their cash.

Inform us how the service works. Can customers make use of Stackin’s tech to handle their on a regular basis budgets?

Once we discuss budgets, we imply two issues:

+ What’s the life (and way of life) we need to lead?

+ What are the behaviors that help us getting there?

Utilizing Stackin, customers are coached to assist them establish what it’s they need to use their cash for, and to construct sustainable behaviors that make these attainable. Collectively, we assist our customers establish behaviors they need to change, or new ones they need to begin.

The only instance of that is spending. All of us have spending behaviors that we don’t love and need to change. Utilizing Stackin we will help customers establish what that habits is, after which begin to shift that habits to liberate cash and use it in a approach that matches what they need.

Stackin additionally helps customers put together and cope with disaster. Are you able to clarify how that works?

Managing cash is a mixture of skillset and mindset. The skillset is acquainted to most of us: attempt to spend lower than you make, construct up an emergency fund, and so forth. Your mindset isn’t talked about as a lot. That’s the place we begin: we will solely management ourselves, not the world round us.

Stackin helps customers to first perceive themselves, what they consider and the way they behave. That consciousness is essential to being resilient and staying calm. Pairing that mindset with the behaviors that our customers construct up helps them to remain afloat it doesn’t matter what disaster they’re confronting.

Begin by discovering out what your dominant cash perception is with our free Stackin assesment designed to do exactly that. When you be taught extra about this, obtain the app and get began!

Get readability. Really feel good. Be assured. Full Stackin’s free evaluation to evaluate your present “relationship” with cash. Then, observe together with Stackin’s customized insights and private teaching to develop your confidence round your objectives, spending, and long-term planning.

This story is dropped at you in partnership with Stackin. Every so often, TCM editors select to companion with manufacturers we consider in to carry our readers particular presents. All materials on The Chalkboard Magazine is supplied for instructional functions solely.

[ad_2]

Source link